How do I Find Out My National Insurance Number

Hello and welcome to our blog. In this article, I’ll tell you how to check your national insurance record and why that’s important.

The Importance of National Insurance Contributions

So Why is that important? Well, not only do your national insurance contributions pay towards the NHS, the police, and stuff like that, but it also pays towards your state pension. So that’s important that when you retire, you’ll get a minimum state pension from the government every month to live off. On top of that, you’ll have your pensions, your other incomes, and stuff like that, but the foundation should always be your state pension.

To get your state pension, you need to give x amount of full national insurance contribution years.

Article Content

- How to check your national insurance records

- How to check if you’ve got full-year contributions

- How to top up those contributions if you need to manually

- Also when your state-age pension is going to be

How do I Find Out My National Insurance Number

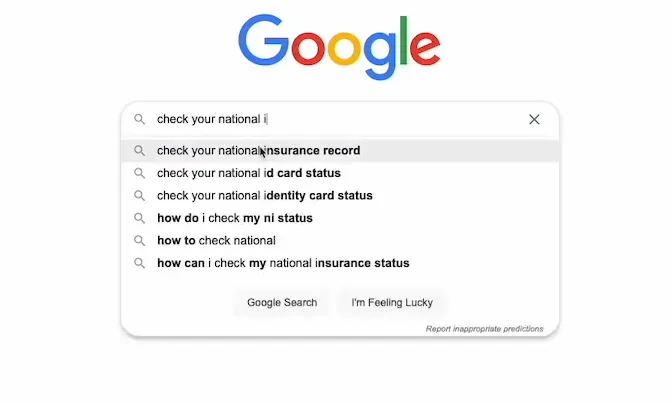

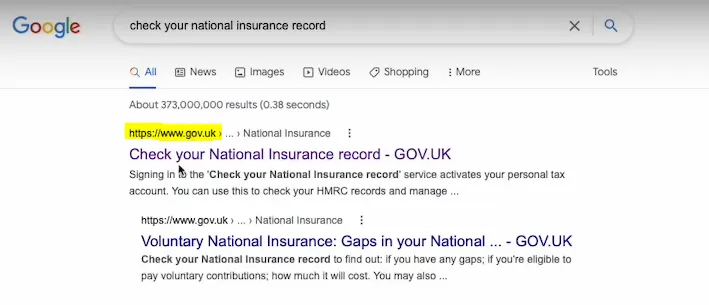

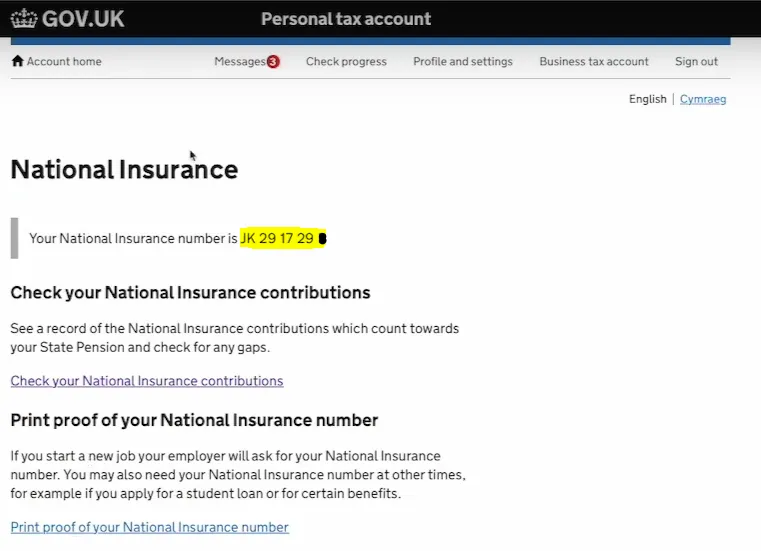

- To check our National Insurance Number is simple. All we do is go to Google, we type in “check your national insurance record“.

- It starts to come up and the first option, providing it says gov.uk, should be the one you’re going for.

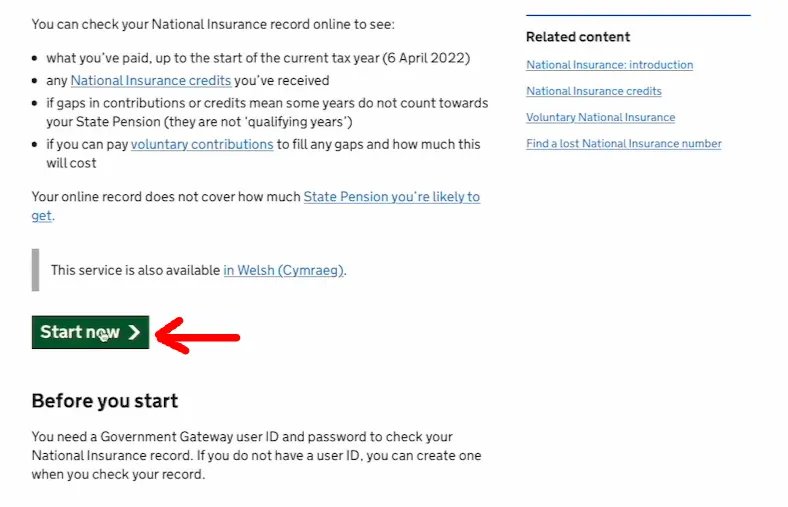

- It’s going to explain on the screen what we’re going to do. It’s going to tell you what you’re looking at, and how to get started.

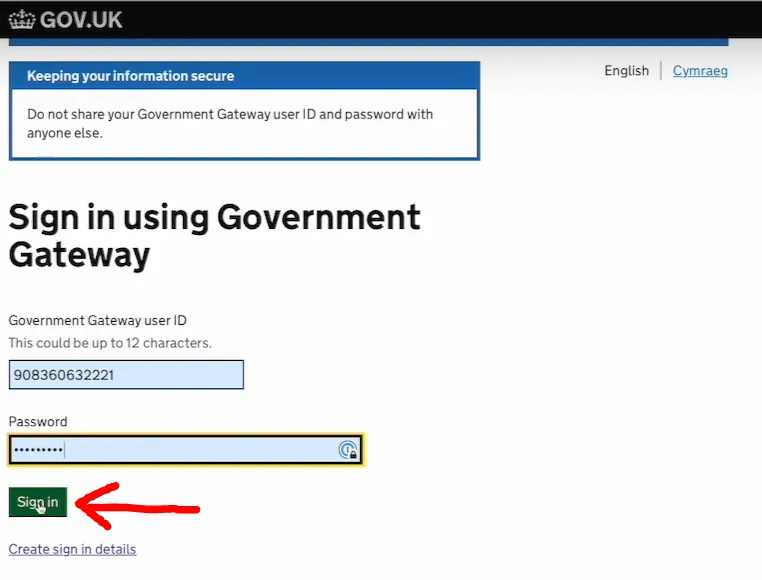

- So we press “Start now”, and you’ve got to sign in to your government gateway.

- If you’ve not got a government gateway, then it’s worthwhile having one because this is where you can see all the information HMRC has on you.

- So if you haven’t got a government gateway, if you click on “Create sign-in details” and you just follow the process, it’s really quick and easy.

- In this case, I’ve got a government gateway, you have to enter your credentials and press sign in.

- After that, you can access your National Insurance Number and now you know How to Find Out Your National Insurance Number.

Accessing Your National Insurance Record

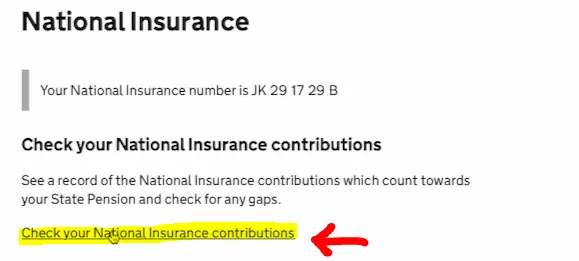

You can also check your National insurance record if you want to buy by clicking on the “Check your National Insurance Contributions” link.”

Advice on Managing Your Contributions

Now if you’re young and you’re not retiring for, in my case, another 33 years, I wouldn’t worry about a couple of part years early on. I’ll just leave them knowing that I’m going to continue working full time and fill my contributions up at a later date.

If, however, you’re looking to retire in the next couple of years or you’re getting close to the state pension age, then it’s worthwhile coming on here, checking that every year is a full year, and if it’s not, paying a voluntary amount to bring it up to a full year.

Because it’s only with full years that you’re going to get your state pension and the maximum you’re allowed. If you’ve got part years, that starts reducing the amount you’re going to get from your state pension. So you must do this.

Additional Features

Another thing you can do here is you can print the national insurance record. So you might be asked by a debtor, the bank, or the benefits department of pension providers to prove that you’ve got your full year’s worth of contributions. So you can do that by printing your national insurance record.

The Importance for Business Owners

The reason this is important and the reason we discuss it quite a lot with our clients is a lot of our clients run limited companies. And for years and years, their previous accountants or their best mate down the pub, Nick, has told them just to pay themselves a minimum salary of eight and a half thousand pounds, nine thousand pounds, and to pay themselves in dividends because dividends is a lower tax rate and they’re not subject to national insurance.

Now, this whole plan is great for tax effort, reducing your tax bill today, but what happens when you’re 55, you’re eight years away from retiring on the state pension, and you suddenly realize you’ve got no national insurance contributions? So you’re not going to get a state pension. Now what? Have you planned for that? Did you realize you were doing that? Most people don’t.

So every time I sit down with a new client, I have a look at their national insurance records and work out: Have they planned for this? Do they need to do some backdating and voluntary payments to top it up? Are they going to be okay? Because I think that’s the responsible thing to do, the ethical thing to do. We’re not just planning for tax savings today and this year, but are we planning properly for their future?

Conclusion

There we go, really quick and easy. Google it, create a login if you’ve not got a login for the government gateway, login, and have a quick look. If you need to make some manual payments, you need to make some manual payments to top it up. But if you’re young, you’ve still got time to make those full-year contributions and not have to worry about the part-year ones earlier in your career.

If you need any more advice on this, please let us know in the comment section, and if you want to know more about how to apply for the National Insurance Number you can check out specific articles on that topic.

Hope the article has been useful and as always, Share it if you liked our information, bye.